| Table of Contents |

|---|

There are three elements that influence the tax calculation process in M2E Pro:

...

| Info |

|---|

This option appears if you set Tax Source to Amazon or Amazon & Magento. |

It allows sellers not to include VAT in orders with UK shipment.

...

None – the VAT won't be excluded and will be displayed in all orders.

All orders with UK shipments – M2E Pro will exclude VAT from all orders with UK shipments.

Orders under 135GBP price – M2E Pro will exclude VAT from orders with a total amount under 135 GBP.

| Tip |

|---|

When you choose to exclude VAT for orders under 135GBP, ensure to have GBP currency set in the Magento directory_currency_rate table to avoid synchronization issues. |

Exclude EEA VAT collected by Amazon

This option allows you not to include VAT in orders with EEA shipment.

...

If enabled, you can select EEA countries for which VAT has to be excluded.

...

| Page Properties | ||

|---|---|---|

| ||

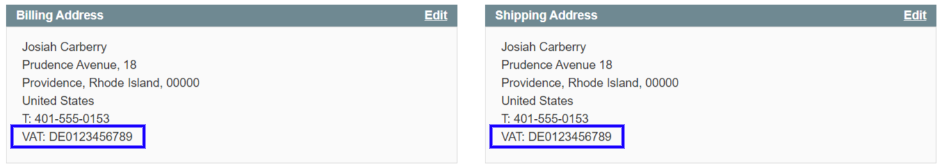

Import Tax Registration Number to Magento Order You can opt for importing Tax Registration Numbers to your Magento Orders. Once enabled, find the Tax Registration Number displayed as VAT in the Shipping Address of your Magento Order.

|

...