Important: This is a legacy version of the documentation. Please visit the current documentation page.

Tax calculation in Magento Orders (examples)

Once the Amazon order is imported to M2E Pro, the corresponding Magento Order can be created based on the configured Account Settings.

The way tax is calculated for the Magento Order depends on the selected Tax Source and Magento Tax Settings.

See the examples below to find out the logic of tax calculation with different settings in Magento and M2E Pro.

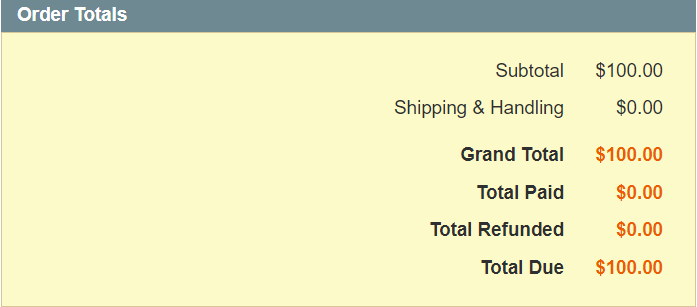

Example 1. Tax Source is set to None

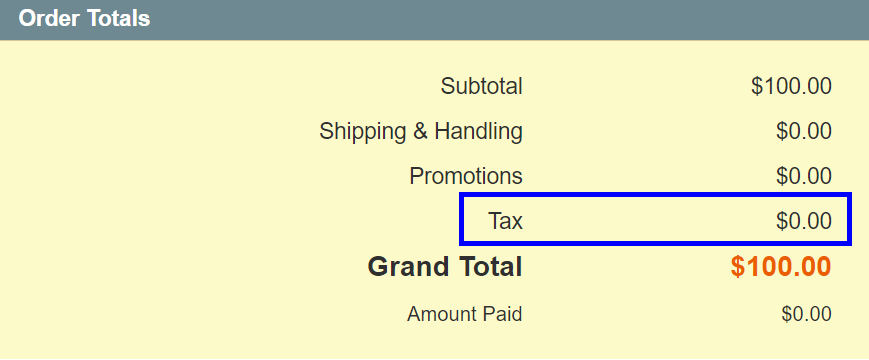

If the Tax source is set to None both Amazon and Magento Tax settings will be ignored. As shown in the screenshot, the Magento Order will contain no tax amount.

Magento Order Totals

Example 2. Tax Source is set to Amazon

When you select Amazon as a Tax Source, the tax in Magento Order will be calculated according to Amazon tax settings.

Via the M2E Pro Selling Policy, you can specify a VAT rate value that will be added to the price when a Product is listed on Amazon. An item price will be increased by the specified VAT Rate value.

Still, no actual VAT rate will be submitted to Amazon.

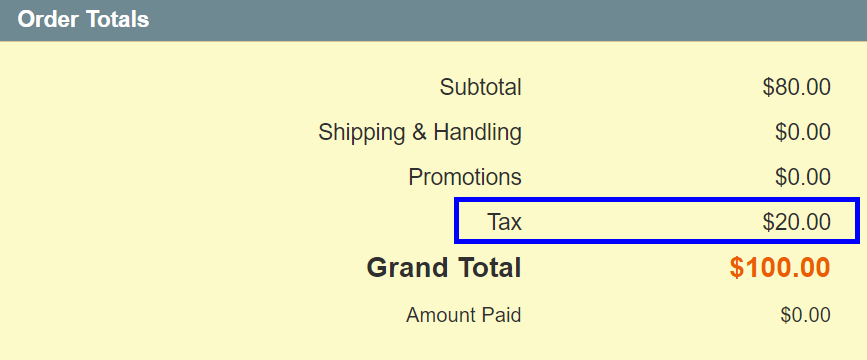

Tax is included in the item final price

Let's see how the calculation works when you apply 20% tax to the Amazon item with no change to its final price.

This way the Magento Product of $100 will be listed on Amazon at the same price. It already contains a 20% tax amount.

When the Amazon order with a 20% tax is imported to M2E Pro, the Magento Order with the 20% tax amount will be created.

Amazon Order Totals

Magento Order Totals

Sometimes the order currency can differ from the Magento base one. In this case, Magento converts the order price to the base currency and calculates tax. Then both price and tax are converted back into the order currency. You can find them in brackets in the Order Totals.

You can configure the currency settings under Magento System > Configuration > General > Currency Setup > Currency Options.

Tax is excluded from the item final price

Now let’s find out how tax is calculated when 20% tax is excluded from the Amazon item final price.

In this case, the Magento Product of $100 will be listed on Amazon with a price of $120.

Both Amazon and Magento orders will have a 20% tax amount.

Amazon Order Totals

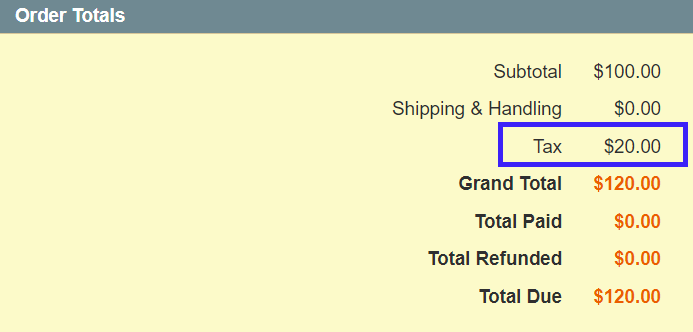

Magento Order Totals

Example 3. Tax Source is set to Magento

If you set Magento as a Tax Source, any tax value returned from Amazon will be ignored. Magento will use Tax Rules for tax calculation.

If there is no appropriate Tax Rule set under Sales > Tax > Manage Tax Rules, the Magento Order will be created with the 0% tax.

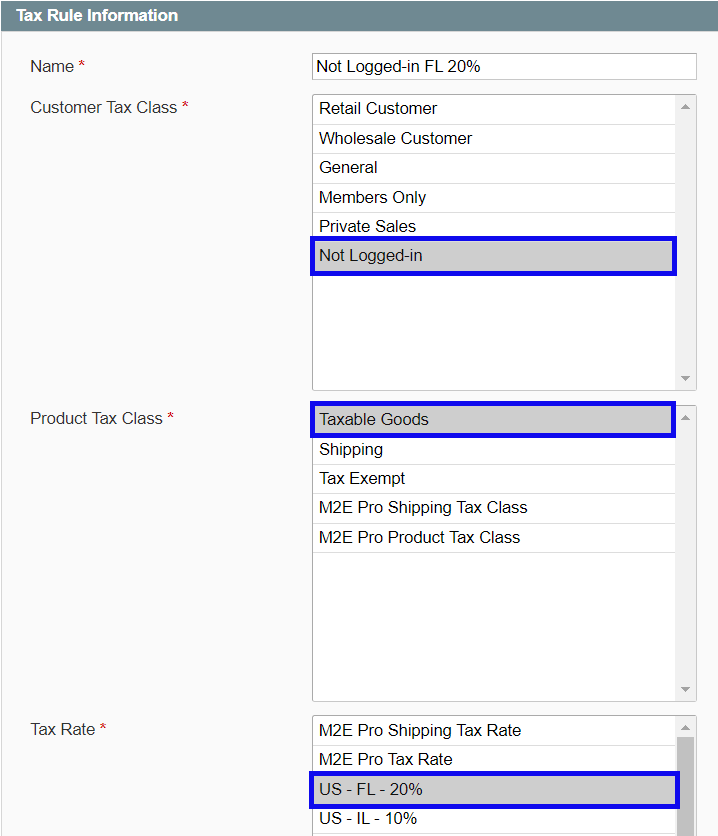

Let’s configure the Tax Rule for Not Logged-in Customer Group, Taxable Goods Product Tax Class, and +20% for Florida Tax Zone/Rate.

It means that the 20% tax will be applied to the Magento Order with items related to Taxable Goods purchased by the Not Logged-in customer from Florida.

The proper tax amount will be applied to the Magento Order only in case the order details match all conditions provided in the Tax Rule.

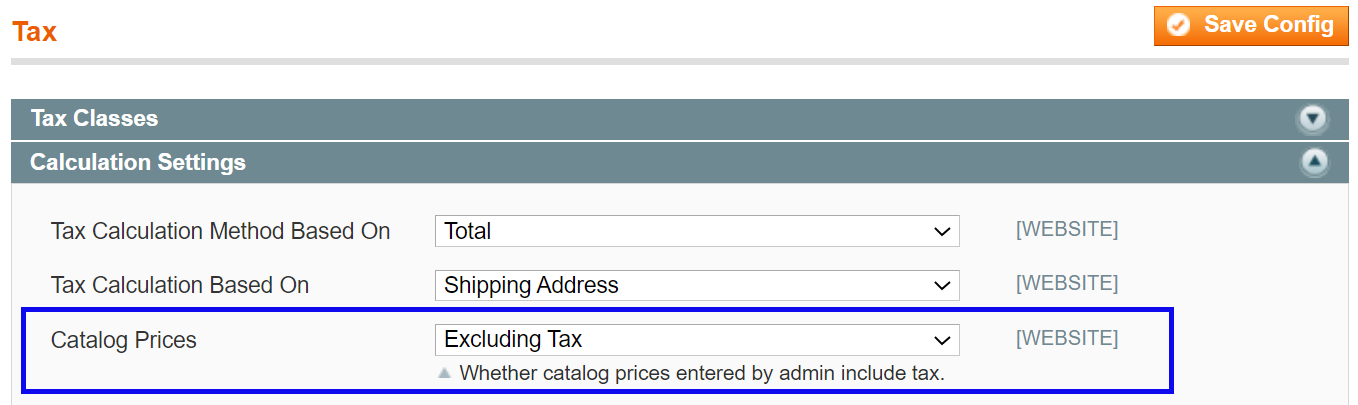

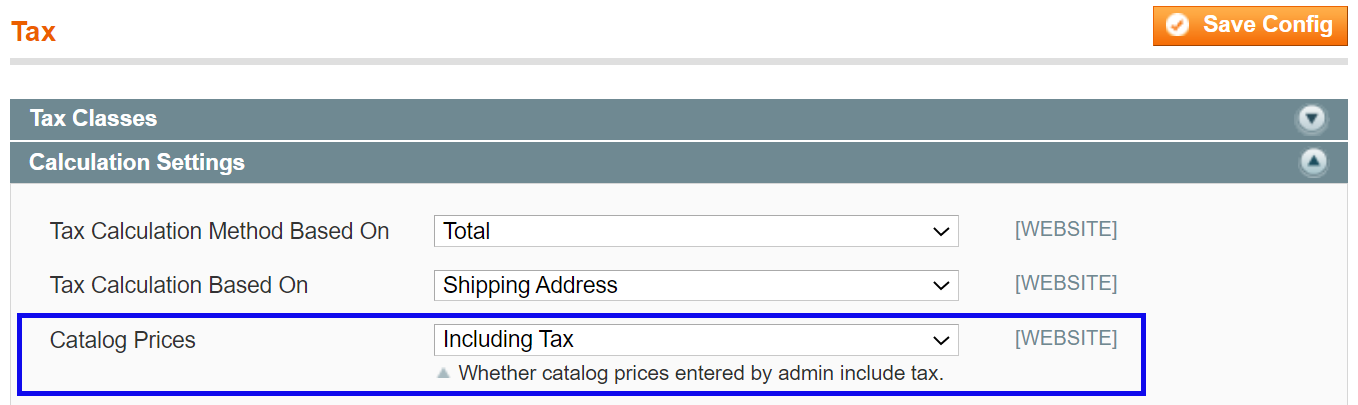

The way tax is displayed in the Magento Order depends on your Calculation Settings. Configure them under System > Configuration > Sales > Tax.

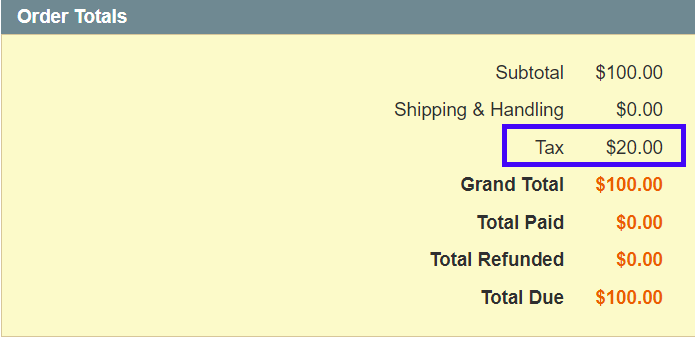

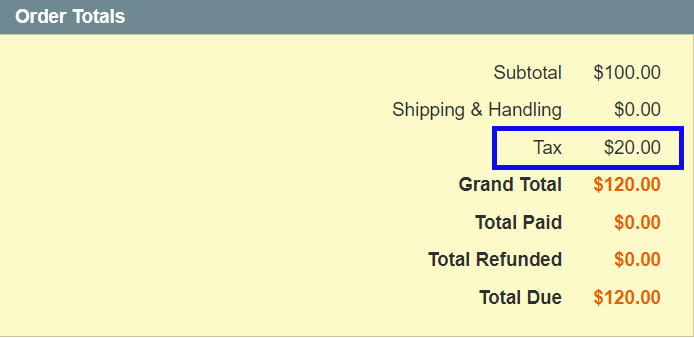

- If the Catalog Prices are set to Excluding Tax, the tax amount will be added on top of the Magento Product price.

So, based on the Tax Rule above, the Magento Product of $100 will be listed on Amazon at an equal price.

The imported Amazon order will contain no tax. The Magento Order will include 20% of the tax amount.

Amazon Order Totals

Magento Order Totals

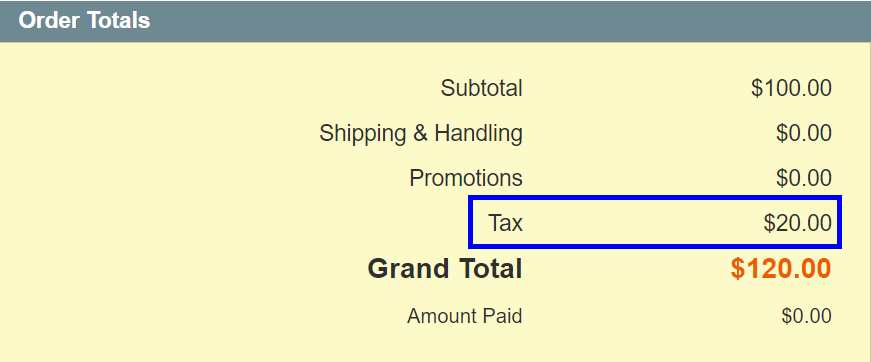

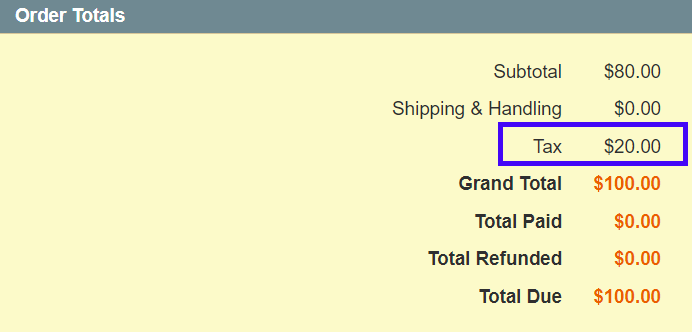

- If the Catalog Prices are set to Including Tax, the tax will be calculated into the final Magento Product price.

According to the mentioned Tax Rule, the Magento Product of $100 will be listed on Amazon with a price of $100.

The Amazon order will be imported with 0% tax. The Magento Order will have a 20% tax amount.

Amazon Order Totals

Magento Order Totals