Important: This is a legacy version of the documentation. Please visit the current documentation page.

Calculation Tax Settings

There are three elements that influence the tax calculation process in M2E Pro:

- Magento Tax Settings

- Walmart Tax Settings

- M2E Pro Tax Settings

To understand how the tax is calculated, see a detailed description of each of these elements below.

Magento Tax Settings

They include the setup of Tax Classes, Tax Rules, as well as Magento system tax configurations.

Tax Classes

Magento has three Tax Classes based on which tax will be calculated:

- Tax Zones & Rates

- Product Tax Class

- Customer Tax Class

Tax Zones & Rates

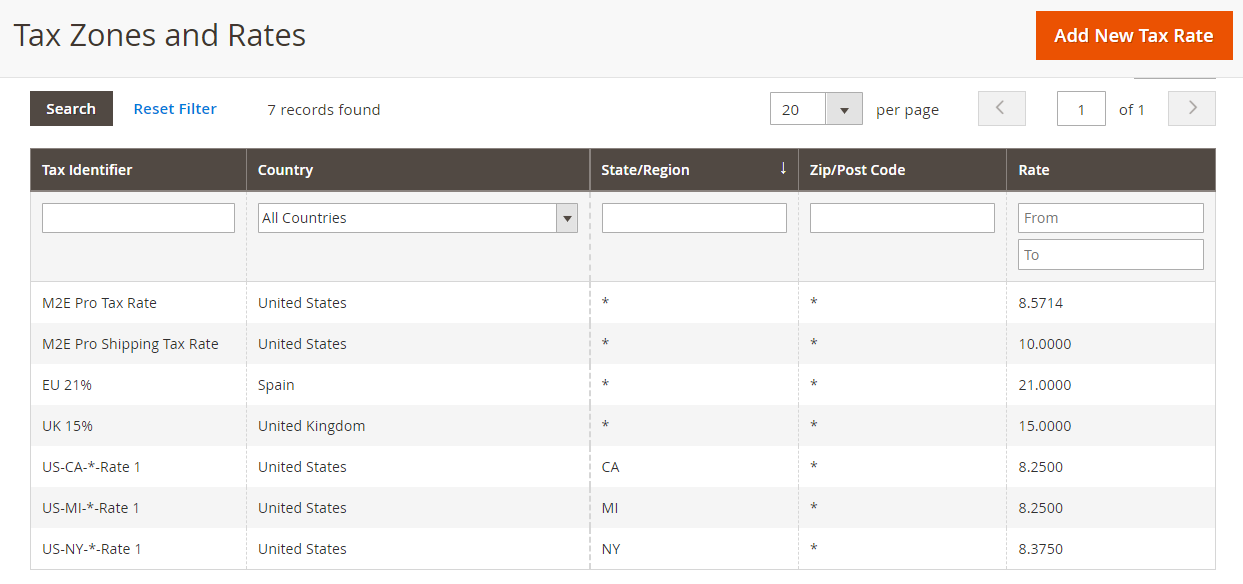

Tax Zones & Rates define the tax applicable depending on the customer’s location (determined by the customer’s shipping or billing address). You will find them under Stores > Taxes > Tax Zones & Rates:

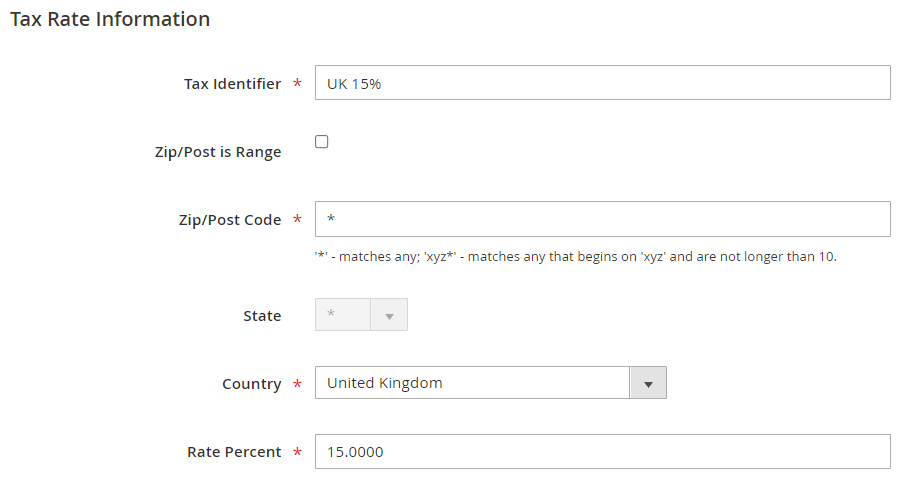

By clicking on the Tax Rate, you can edit its Country, State, ZIP/Post Range/Code, Rate Percent at any time:

Product and Customer Tax Classes

Product and Customer Tax Classes define the tax applicable to a particular Magento Product or a particular customer accordingly.

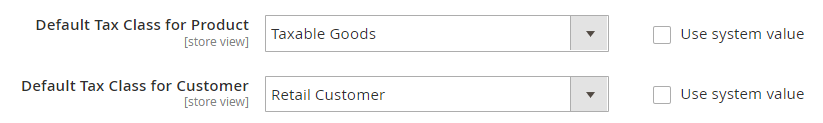

All Products and Customer Groups in Magento have a default Product/Customer Tax Class assigned to them automatically. You can check these settings under Stores > Settings > Configuration > Sales > Tax:

There you can also choose another default Tax Class for your Products and Customer Groups.

Besides, it is possible to override the default Tax Class for a particular Magento Product or Customer Group.

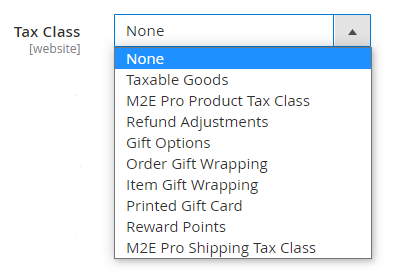

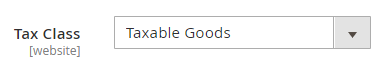

To assign a non-default Product Tax Class to a Magento Product, use the Tax Class option in Magento Product settings:

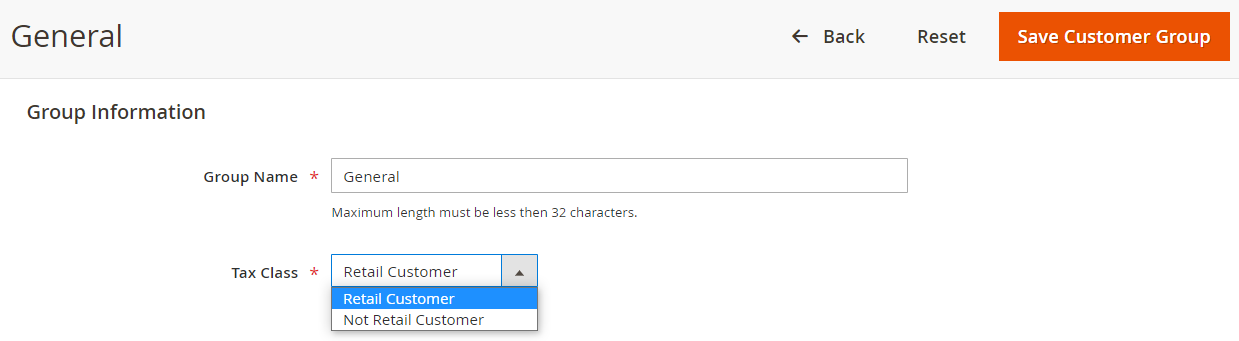

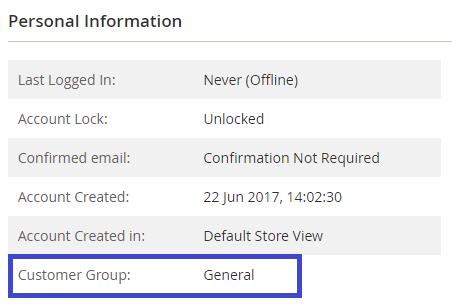

To assign a non-default Customer Tax Class to a Customer Group, go to Customers > Customer Groups > Tax Class:

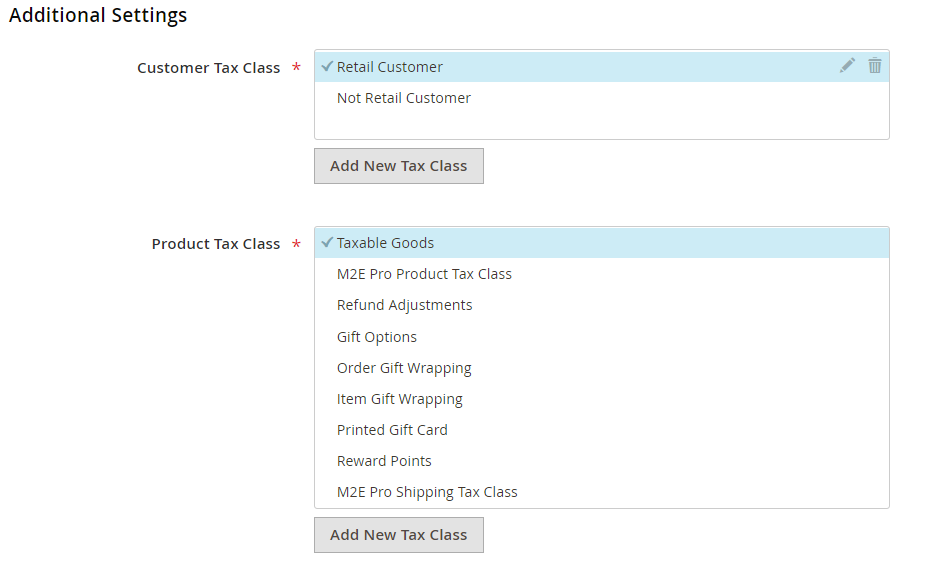

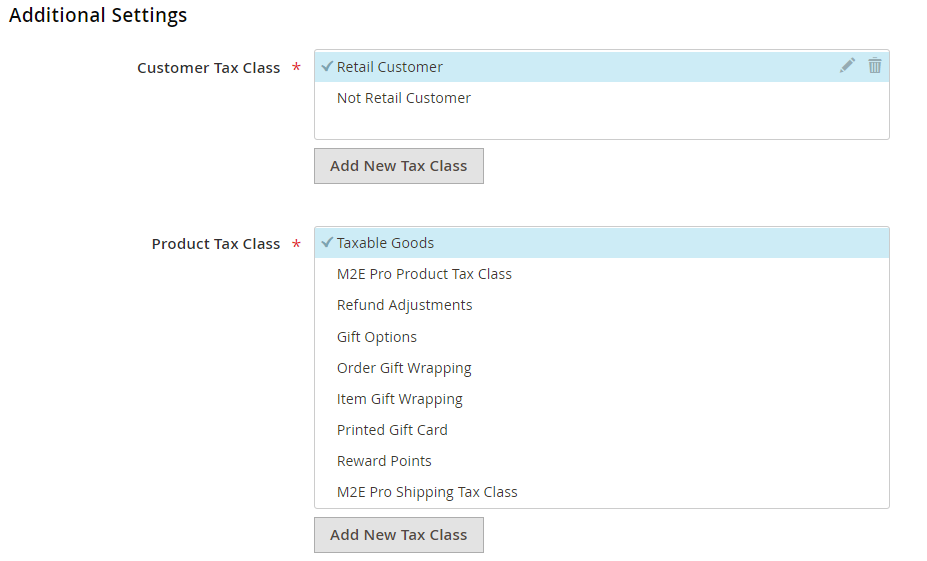

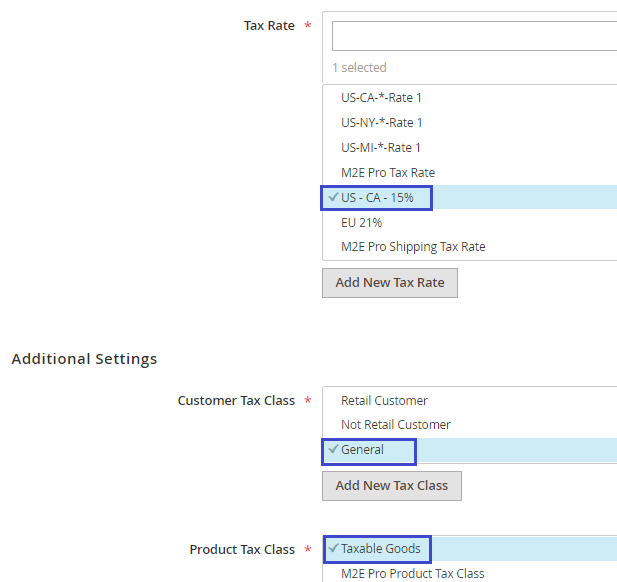

You can manage Product and Customer Tax Classes at the step of adding new Tax Rules or editing existing ones (Stores > Tax Rules > Add New Tax Rule > Additional Settings):

Tax Rules

Tax Rules combine Product Tax Class, Customer Tax Class, and Tax Zone & Rate. These rules define the final tax amount applicable to a particular Magento Product that was bought by a particular Customer from a particular Location.

Setting up Tax Rules is essential. Otherwise, tax rates will not be applied to the Magento order.

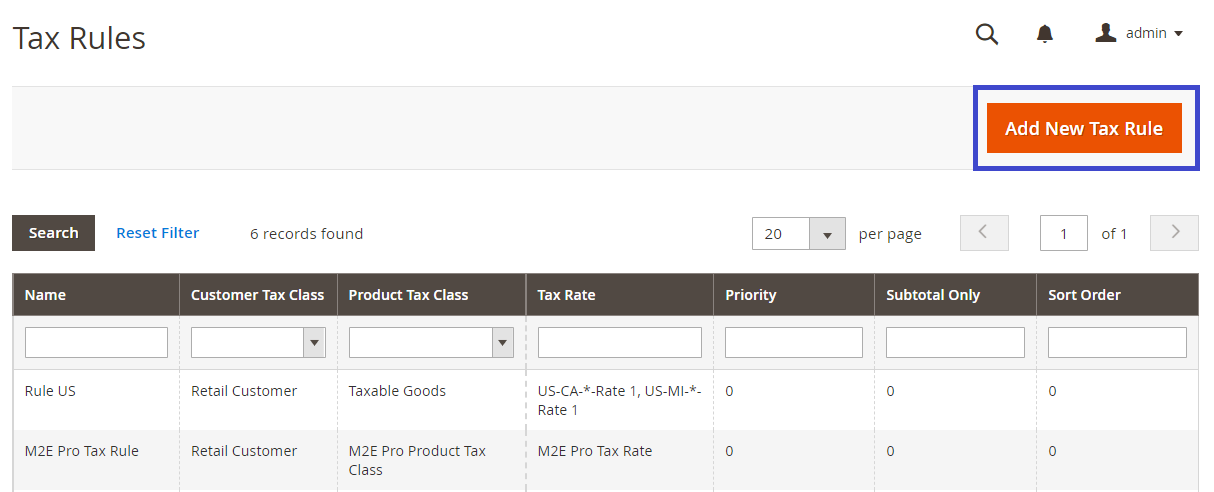

To add a Tax Rule, navigate to Stores > Taxes > Tax Rules:

When configuring a new Tax Rule, Magento will automatically use the default Product and Customer Tax Classes specified under Stores > Settings > Configuration > Sales > Tax for a particular Website/Store View.

Under the Additional Settings section, you can indicate another Product/Customer Tax Class for your Tax Rule, if necessary:

Let’s see how a tax rate is calculated for Magento order based on the configured Tax Rule.

Tax Rules Example

Your Magento Product is set up to use the Tax Class Taxable Goods.

A customer, who placed an order, is related to the Customer Group General.

The ordered item should be shipped to California.

You have set up a Tax Rule that adds a tax percent of 15% to a Magento Product belonging to Taxable Goods, purchased by a buyer from the General Customer Group who lives in California.

Thus, the tax rate specified in your Magento Order will be 15%.

If one of the Tax Rule components (Product Tax Class, Customer Tax Class, or Tax Zone) is different from the data in Magento Order, the tax rate will not be applied.

Magento System Tax configurations

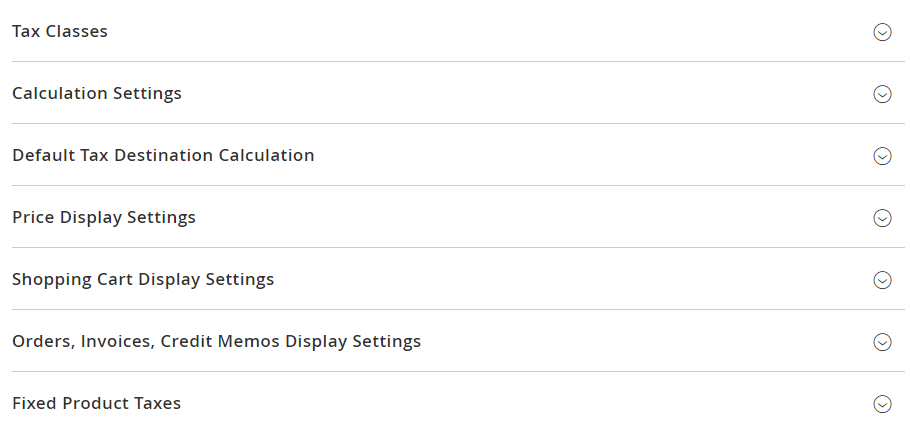

Apart from Tax Rules, there are general Magento tax settings that determine the final tax amount in the order. These settings are located under Stores > Settings > Configuration > Sales > Tax:

The settings in this section can be configured for a particular Website/Store View of your Magento.

Tax Class for Shipping

If your store charges a shipping rate, you can specify a separate Product Tax Class that will be used for shipping by default:

A shipping rate will be applied if the selected Tax Class for Shipping is included in a Tax Rule.

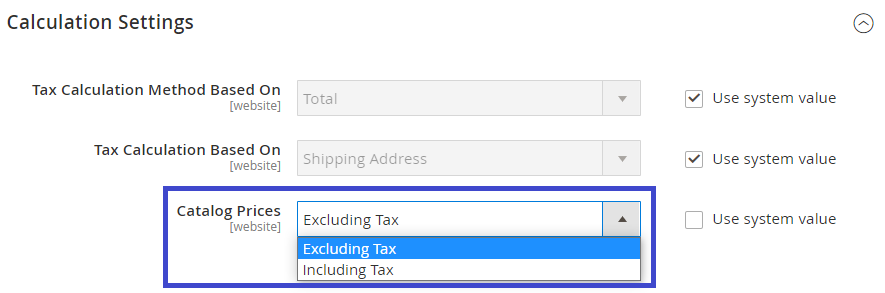

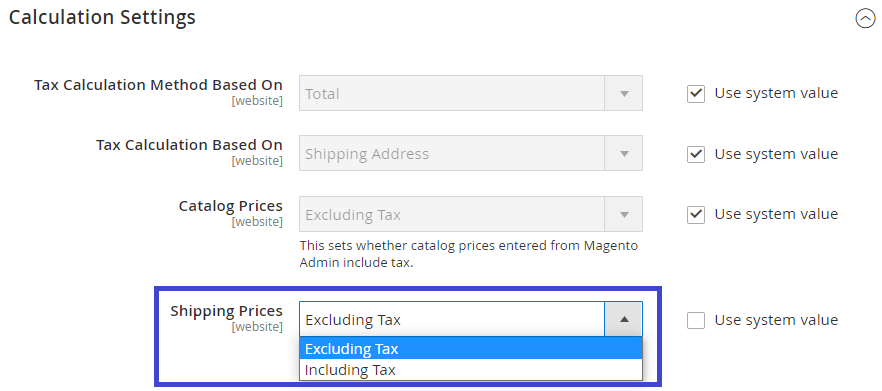

Calculation Settings

Catalog Prices

Determines whether the final Product Price should include tax or not.

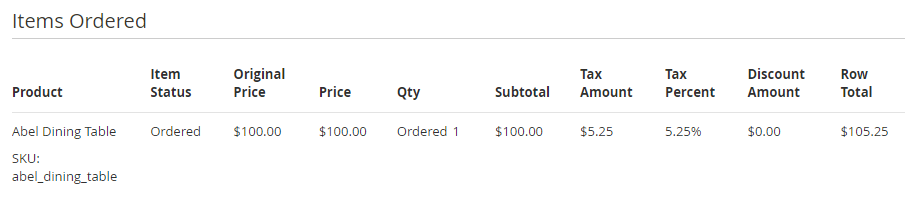

If the Product Price is set to exclude tax, the tax rate will be added to the final price.

For example, the Magento Product Price is $100, the tax percent is 5.25%. The final product price will be $105.25.

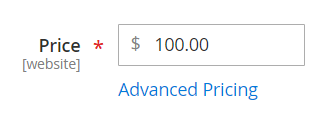

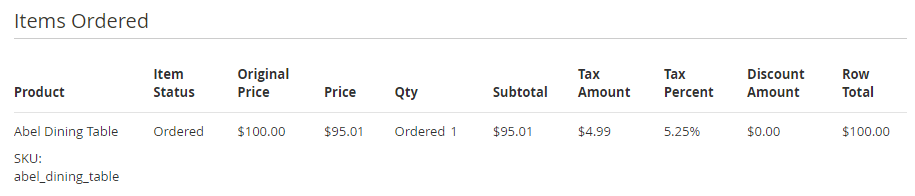

If the Product Price is set to include tax, the tax rate will be calculated into the final price.

For example, the Product Price in Magento Catalog is $100, which already includes the tax amount of 5.25% ($4.99).

The Product Price displayed to customers will be $95.01:

Shipping Prices

Determines whether the Shipping Price should include tax or not.

If the Shipping Price is set to exclude tax, the tax rate will be added to the final shipping price.

For example, the Shipping Price is $10, the tax percent is 5%. The final Shipping Price will be $10.50.

If the Shipping Price is set to include tax, the tax rate will be calculated into the final shipping price.

For example, the Shipping Price is $10, which already includes the tax percent of 5%.

Shipping Prices depend on the Shipping Methods configured in Magento.

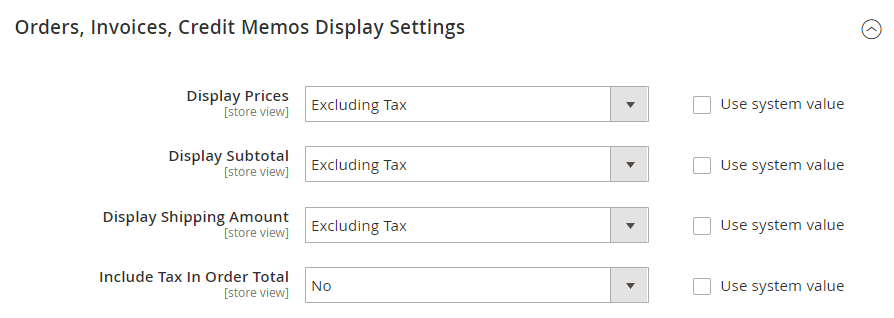

Orders, Invoices, Credit Memos Display Settings

Determines whether the Product Prices, Shipping Amount, Subtotal, and Grand Total, which are displayed in Magento Orders, should include or exclude tax.

For more information on configuring Magento Tax settings according to your business needs, check out Magento docs.

Walmart Tax Settings

You can configure tax settings directly in your Seller Center under Settings > Taxes.

M2E Pro Tax Settings

They include the setup of Product Tax Code settings in Selling Policy, as well as Order Tax settings in Walmart account configurations.

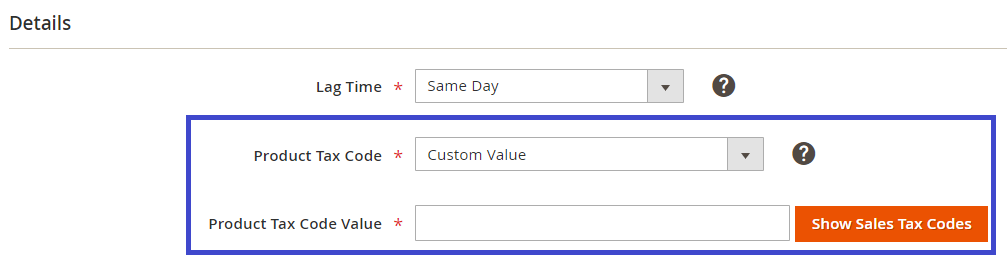

Product Tax Code settings in Selling Policy

Under the Details section in Selling Policy, you should provide a product tax code (PTC), which is assigned to a taxable item. Walmart uses PTC to automatically calculate taxes on each sale based on the item sold and delivery location.

Either select Magento Attribute where the relevant tax codes are stored or enter a custom tax code value. If you choose the Custom Value option, you can add the relevant PTC from the list of current sales tax codes by clicking Show Sales Tax Codes.

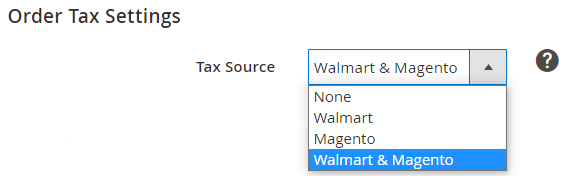

Order Tax Settings

Tax Source

Under the Order Tax Settings section in your Walmart account configurations, you can select which tax source should be applied during Magento order creation:

- None - neither Amazon nor Magento tax settings will be used. Magento Order will not contain any tax values.

- Walmart - the tax in Magento Order will be calculated based on Walmart tax settings.

- Magento - the tax in Magento Order will be calculated based on Magento tax settings.

- Walmart & Magento - the tax in Magento Order will be calculated based on the tax amount in the imported Walmart order. If the tax amount is not specified, Magento Tax settings will be applied.

M2E Pro Tax Rate and M2E Pro Shipping Rate

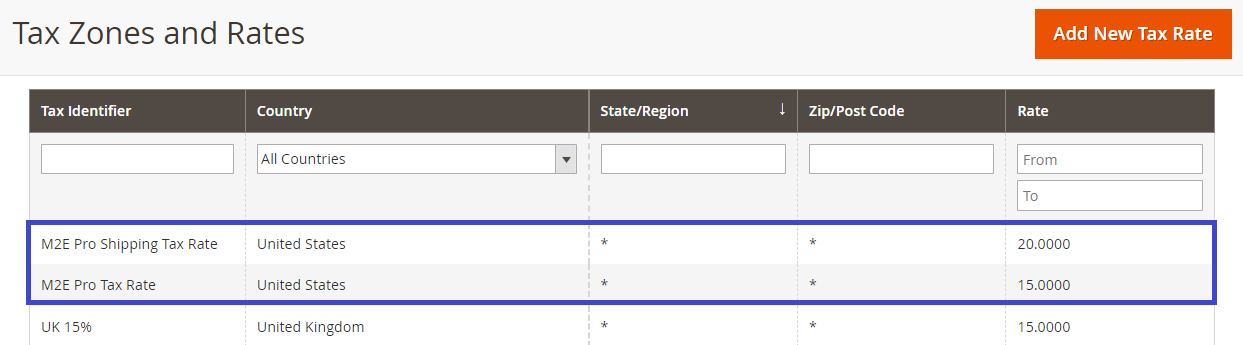

If you choose Walmart or Walmart&Magento option as a Tax Source, you will find two additional options on your Tax Zones and Rates page in Magento:

M2E Pro uses them to transfer tax value that is returned from Walmart order to Magento order. In other words, M2E Pro Tax Rate and M2E Pro Shipping Tax Rate are used to adjust the Walmart tax into the Tax Rule. This way, Magento can recognize and display tax in Magento order properly.